A huge week for crypto

As many people know, the Bitcoin ETF was approved on January 10th of this year and went live shortly after, leading BTC to new All Time Highs. The crypto market as a whole had been going up since the end of 2022, after the insane FTX bankruptcy ended up marking the bottom.

The cryptocurrency market cap is 2.72 Trillion (with a T) dollars at the time of writing.

Crypto’s usage and ownership is more widespread than ever before.

An estimated 52 million Americans own crypto (a slightly higher percentage of people than in Europe, but lower than in Asia). Big numbers, in a trend that became more and more apparent from 2020 onwards and is now well-established. A lot of people like crypto. It’s not perfect, but the glaring inadequacies of ‘tradfi’ or government-controlled financial systems are increasingly apparent and a growing number of people and institutions are grasping crypto's power to provide democratized access to wealth free from inflationary risks, intermediary fees and exclusionary banking processes that have kept an unnecessarily large part of the world’s population unbanked.

It’s tough to say exactly how many, but one can reasonably assume that at least a part of these people will be single issue voters, mainly due to the generational loss of faith in a system that has two old men run against each other in a rerun of the Biden-Trump race that the overwhelming majority of the people actually doesn’t want to see happen. For many people, blockchain technology represents precisely that: the possibility of modern innovation that is needed to step away from both archaic processes as well as from opaque and gerontocratic nepotism in a structural way.

Despite all that, crypto is often still viewed as a fad, a fringe technology, with a lack of clear regulation. Some, understandably, mistake the criminal acts of certain individuals with a verdict about the blockchain technology itself. The EU is giving it a real shot with the MiCA regulation going live in July, but in the USA, it remained a largely unregulated technology, pretty much hated by both Democrats and Republicans - until recently. I’d like to go on the record to say that I totally called it.

Let’s rewind a bit, with some headlines from 2023, to show the regulatory landscape, post the FTX collapse.

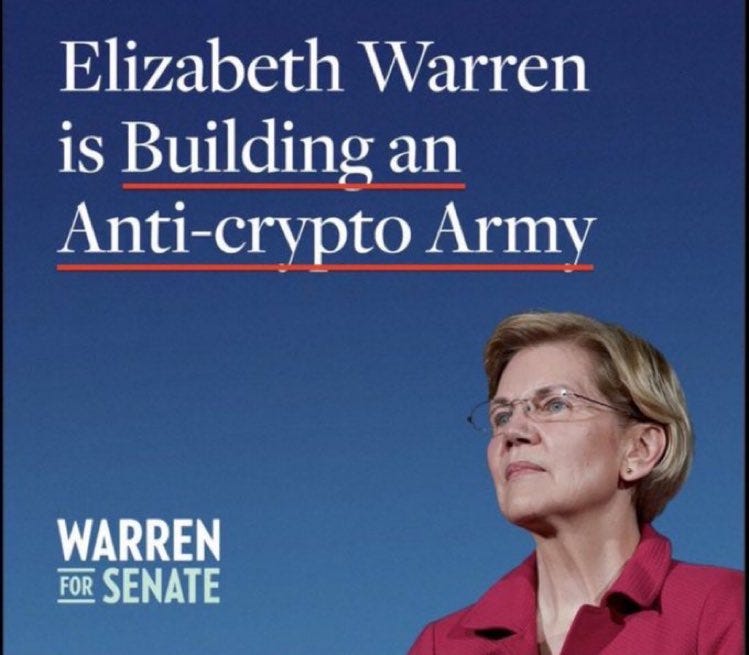

Early in the year, banks were under pressure to stop doing any kind of business with crypto companies, which you could extrapolate as financial persecution on ideological grounds, whether you think that’s a good thing or not. Meanwhile, Elizabeth Warren starts running on a political platform that is very vocally anti-crypto.

The Securities and Exchange Commission (SEC), who failed to stop FTX, Celsius, Voyager, BlockFi, or any of the other fraudulently operating companies from stealing from retail customers, goes on a spree. They start saying the quiet part out loud, even if their mandate is to uphold the Securities Act from 1934 (which is a whole problem in and of itself of course), and not to make ideological statements like the below. In hindsight, this was just such a huge faux pas, it’s incredible. The SEC also claims jurisdiction over crypto on the basis that all digital assets are securities, leading to a turf-war between different government agencies about who has jurisdiction to regulate digital assets in the first place.

They sue companies that made their best efforts to be compliant and never hurt users like Coinbase, Kraken, Uniswap, Metamask in the months that follow, in what becomes an ideological tug-of-war between the crypto industry and a seemingly ideologically weaponized SEC, in which the SEC itself also gets some slaps on the wrist.

The Bitcoin ETF approval led by BlackRock leveled the playing field a bit. Even though there is still a lot of regulatory overhang, Blackrock ensured BTC was accepted on Wall Street and definitely lifted a big part of the veil of obscurity that was hanging over the sector, making it clear it would survive the FTX-debacle. Now that you’re up to speed, let’s take a quick look at the chain of events of the crazy last 2 weeks, starting with the proposed ‘SAB121’ legislation. I’m sure I’m going to botch giving the correct summary, but if I don’t write it up now, I’m never going to do it:)

The SAB121 legislation basically states that crypto ownership laws should not fiscally guarantee custodians the same protection rights that other asset classes receive. Congress wanted to repeal this (borderline strange) piece of regulation. Biden then threatened to Veto that decision, so that the law would pass in any event.

Please let this sink in. Some of Obama’s laws were overturned when Trump was in office, some of Trump’s laws were overturned when Biden came in to office. But it is extremely rare to overturn this type of regulation by the party of the sitting president. This is quite a major thing, especially in an election year, and in the current polarized climate. In fact, it makes the repeal of this piece of legislation one of the rare issues that is bi-partisan. That wasn’t on my bingo card. It is very, very noteworthy. You could argue it shows a divide over crypto that is more generational than partisan. And it also shows how bad the proposed bill is.

That said, 21 Democrats sided with Republicans in Congress. Later on in the Senate, 11 senators from the Democratic party did the same, meaning that both the House and the Senate stopped this bill from passing, making a Biden veto the only way to push it through, which would be a very strange hill to die on.

After the Democrats sided with the Republicans to repeal SAB121, it feels like the tide rapidly started turning and things started moving very quickly:

Seeing how much backlash the Democrats were getting from their crypto witch-hunt, and in an opportunistic move that surprised absolutely no one, Trump embraced crypto all of the sudden, saying ‘he’s good with it’ and also calling out Gensler by name. I say opportunistic, because for the longest time, Trump viewed crypto as a threat against USD hegemony (which isn’t even a good argument to make given the fact that dollarization throughout the world can be sped up by stable coins, but I’ll let it slide today). He also announced he’d accept donations in crypto, wants crypto-businesses to operate in the USA, and then also proceeded to go to the Libertarian National Convention, addressing crypto and self-custody.

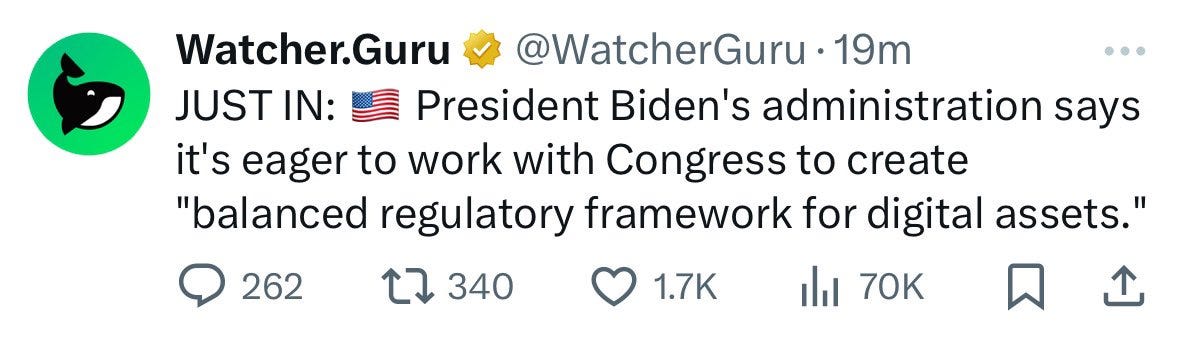

Almost directly after Trump’s first message, I believe a few hours, this happened:

Odds of an Ethereum ETF also skyrocketed from 10% to 75% upon rumors that the SEC seemed to be ‘pivoting’ and was followed by formal approval a few days later, causing a big rally in the price of Ethereum. The SEC lost even more of its innocence here, often hiding behind ‘protecting investors’ (and failing to do so), but then flip-flopping at a moment’s notice after a call from the White House.

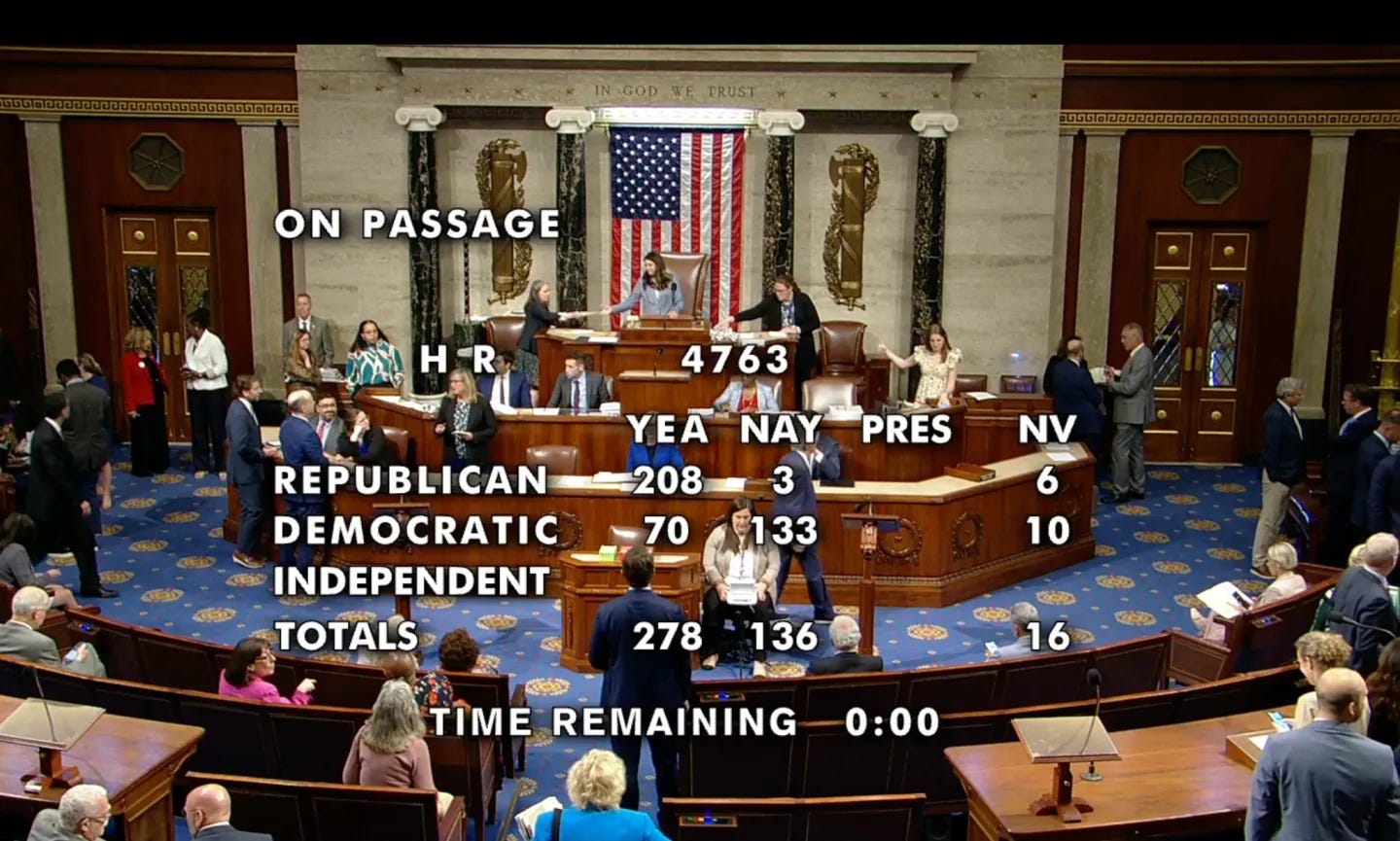

In the same week, the House passed FIT21. The FIT21 Act, or the Financial Innovation and Technology for the 21st Century Act, is a comprehensive legislative proposal aimed at providing clear regulatory guidelines for digital assets in the U.S. Notably, it moves a lot of responsibilities from the SEC to the CFTC, and proposes a new framework to gauge whether or not a digital asset is sufficiently decentralized to be viewed as a commodity. The vote passed with a large majority, after 70 (!!) Democrats sided with Republicans. Also big names like Nancy Pelosi ended up ‘breaking ranks’ with the party vote.

They also passed a bill preventing the Fed from ever building a CBDC, all in the same week. I guess we’ll see how that ends up going.

It should be noted that FIT21 is the first piece of legislation about crypto that has ever been passed (!!) in the USA. There has never been any law about crypto specifically.

Now, I am not naive. Being pro-crypto is more popular now, but who knows if these laws pass the Senate, or if they end up vetoed regardless (political suicide in my opinion, but we’ll see), if the SEC starts wildly attacking again after its forced retreat, or if politicians keep their promises in general. Crypto is by definition not Republican or Democratic, it is merely a technology enabling cooperation and transparency, which is now being used as a political bargaining chip in an election year.

That said, it is more than fair to say that Digital Assets and Blockchain Technology are here to stay and claiming it’s a fad or a fringe issue that should not get any attention, is now, officially, a minority view point. The veil of obscurity continues to be lifted. Bitcoin and crypto in general are more antifragile and more lindy than ever before. The industry didn’t die after FTX, it has multiple ETFs, and it is further away from death than it’s ever been, now with all tailwinds falling into place to actually start thriving.