Custody Battle

Crazy statistic. And here you can find the study. At this point, surely we can all agree that the cryptocurrency debate, and its underlying ethos, will play an increasingly large role in many future political decisions. I’m here for it. So let’s dive in, a lot has happened. In fact, so much is happening every day that it’s become impossible to keep pace with the news.

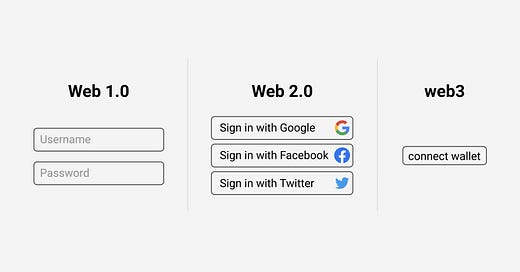

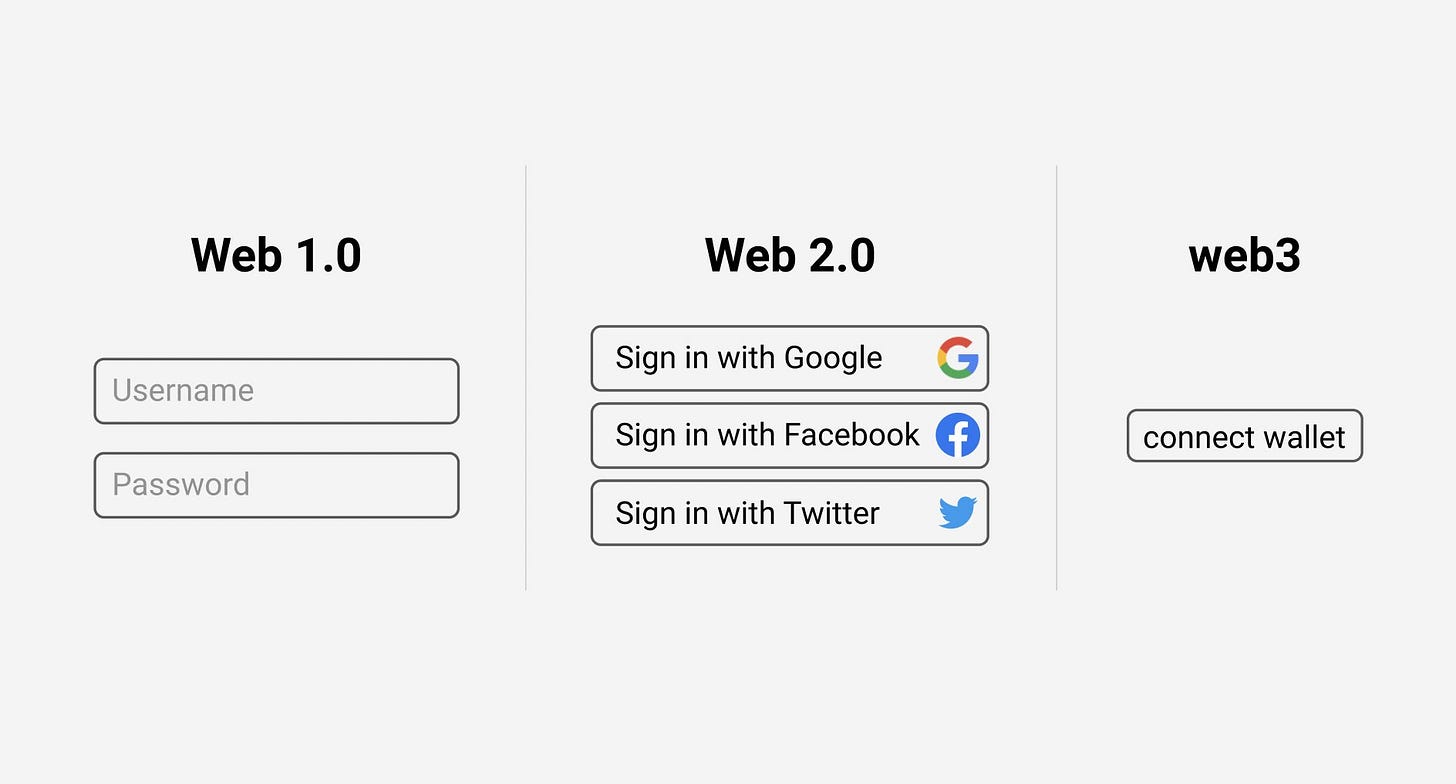

Looking past the froth and the prices of NFTs, I believe that it is important to note that NFTs can basically act as identity and access management single sign-on solutions. Because they are provably yours, and yours alone, in your wallet, you can cryptographically use an NFT as a unique identifier, without needing a log-in or a password - only your private keys. This is an interesting concept.

We tend to conflate identity with official records. Because the state has played a key role in proving our identity, it has encroached into our definition of who we say we are. And I don’t mean this in any negative sense, although I will highlight some limitations (that states are also working on to improve with various apps. Not all bad.). Some of us may feel the state overreaches sometimes, but trustable records (= a ledger) of identities and possessions is also one of the key elements that sets apart the most developed nations and plays a large role in our ability to function in a free society, trust each other, enter into exchanges with others, obtain credit, and so on.

However, as many identity policy experts have started pointing out, there are three types of identity. Legal (linked to identifiability), social (based on our engagements with society, relationships we build, signals we send) and personal, which is how we self-identify. The latter two categories have become more fluid, especially in the age of social media and as our cultures become more open to new ways of defining what it means to be human, whether that breaks down along sexual orientation, gender or religious, racial or ethnic grounds. What is powerful is that the technologies driving those changes now also make it possible to turn these more dynamic aspects of who we are into a means of proof. Primarily in the realm of our social identity.

Another angle, from ‘A Blueprint for Digital Identity’ by the World Economic Forum, is breaking up identity in different attributes: Inherent attributes are intrinsic to the individual and tend to be static (date of birth, height, fingerprints). Accumulated attributes tend to change over time and can include things like health records or shopping preferences derived from online habits. Assigned attributes are conferred on the user by an outside entity with some degree of authority and can include a passport number or an email-address from an employer.

In the age of privacy risk, protecting this data is vital. Digitization lets us break up this data and make it granular or specific, potentially facilitating this protection. Analog IDs or passports, on the other hand, are static. They don’t allow you to strip out different attributes. When you show your ID to a bartender to prove your age in order to get a drink, they will temporarily have access to all the information on your ID. When you need to prove your salary to the bank, they will often also obtain additional data that is irrelevant to the piece of information you set out to prove.

In short, I believe the blockchain ecosystem can play a positive and productive role when it comes to the identity debate, both on the policy level and the data privacy & security level.

Aside from the investment opportunities or the volatility that is present in the cryptocurrency markets, what always interested me the most, was the potential of vastly improved financial system. One that is, for example, more transparent, based on predictable open-source code, more inclusive, operating on a more voluntary basis and one in which participants get rewards for participating. Having trustable and verifiable ways to record identities, or perhaps more importantly reputations, is a key piece of any financial system. But it remains merely a means to an end. So what’s the end?

Censorship-resistance

Historically, the risk of financial censorship has been much lower than it is now, because for the entirety of human history (until approximately 2001), it was mostly uncontroversial that people could have decentralized, non-custodial mediums of exchange. Throughout millennia, humans used commodity money (from tally sticks to gold) and then in the last few hundred years we have had various forms of cash based instruments as well. Please note that all of these are ‘non-custodial’, ‘decentralized’ and not ‘KYC’ed. Over the last 20 years, the institutional environment has shifted to a posture that non-custodial money is by default suspicious. It is effectively a quiet power grab by the state. This is one of the reasons that crypto has been disliked from the onset, by central banks in particular. While their goal has been to usher in the 'end of cash', a new form of digital cash emerged.

Unlike the vast majority of cryptocurrency coins, NFTs are currently protected under the 'Freedom Of Speech' First Amendment in the USA and therefore are less prone to be called securities or to be as heavily regulated, which makes the likelihood that they remain self-custodial much higher than other forms of crypto currently undergoing some form of mainstream adoption. One could say that NFTs are the way to transform the system, playing by the system's rules, when faced with regulatory scrutiny and myriad attack vectors from the incumbent system that takes away basic rights under the guise of 'consumer protection' or ‘domestic terrorism’.

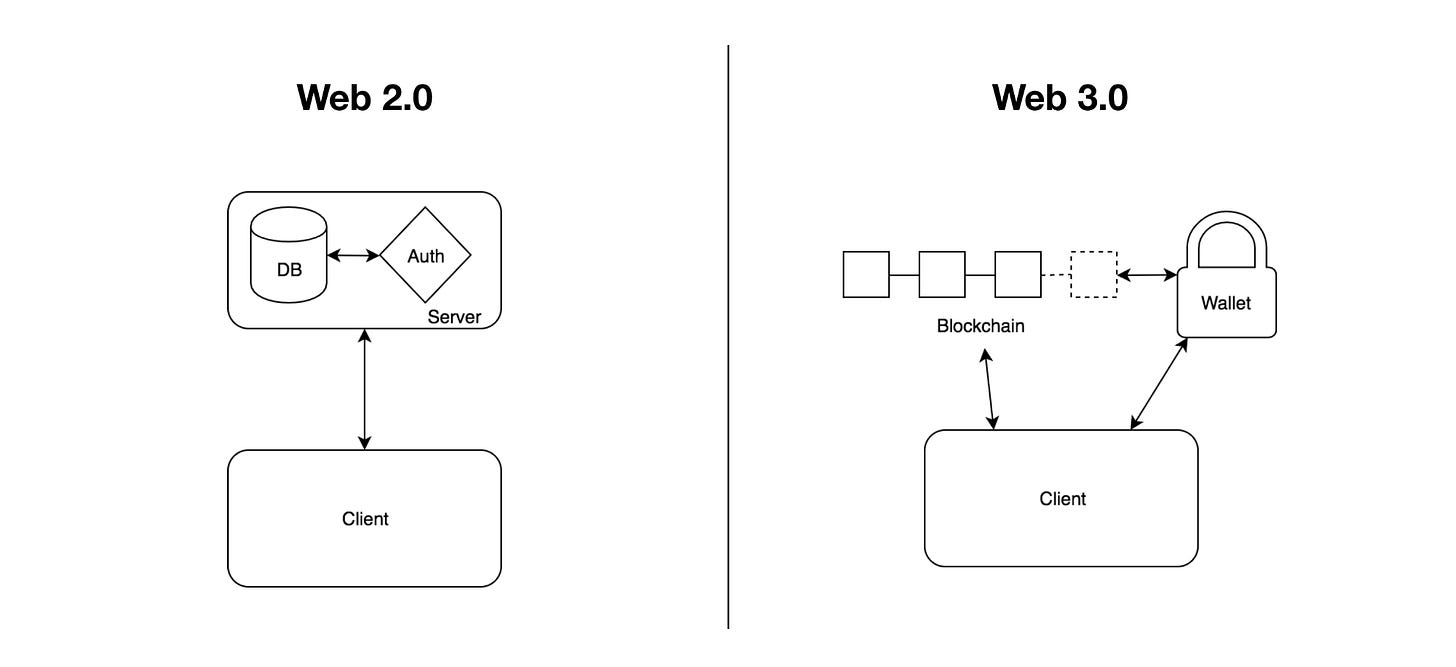

The only regulatory battle that is a must win to have a chance at creating this improved financial system, is self-custody. If we ever lose the right to hold our own coins, or NFTs, nothing else will matter. NFT’s true importance is their ability to be more censorship-resistant than all other current forms of crypto.

The incumbent institutions have already dubbed every self-custodial wallet as ‘non-custodial’ in a very important game of words, and have made it a felony to own an NFT worth over 10.000$ without declaring it. This was a part of The Infrastructure Bill passed last year - a bill, obviously, unrelated to crypto and its future potential and pitfalls, but one intending to re-vamp the economy after the pandemic by injecting lots of money into the money supply. The bill contained some parts that were very hostile towards crypto and unrelated to the goal of the bill as advertised. Its overall economic importance and mediatization made it hard for pro-crypto politicians to block the bill from passing outright, but attempts to let the bill pass while simply removing the rushed crypto clauses to discuss them in congress first, were also successfully fought off. Sad but true, the classic playbook.

When a government says they want to ban Bitcoin (they won’t, but they’ll come for right-to-custody with all they got), the average non crypto-holder might still think to themselves that it might make sense to do so. But if the government wants to ban your right to hold a JPEG in your own wallet, they suddenly have to show their real hand.

When we can hold our own coins, then of course taxes and reasonable bookkeeping (and optional custody for those who prefer it that way) are 100% fine and logical. But if we must deposit our coins somewhere centralized to transact, the whole crypto revolution was likely for nothing because it is no longer based on cooperation of all participants, no longer permission-less, non-confiscatable or censorship-resistant. Essentially a do-over of the current banking system, in which you can no longer choose whether you keep your money in your own digital wallet or the bank’s, even though this option has technologically been made possible. Nor get any interest on your deposits, for that matter.

Quick side-step to further illustrate the stance institutions have chosen to take: BlockFi is a lending platform that pays out 8.75% interest on USD-pegged stablecoins, effectively operating as a savings account for many, made possible because BlockFi actually shares its lending profits with their customers who hold savings deposits:

The idea that the ruling gerontocracy (great word) will, or even could, ‘regulate’ a new technology like blockchain based lending by using a law from 1940, is absurd to me. This is almost like regulating email with the same laws as the post-office. They sure protected all the bad people from receiving 8.75% interest, good job SEC! But I don’t, or at least can’t, believe crypto will truly be regulated this way in the long term. I believe this is too important and will not stand. I’m not a lawyer and of course, I don’t know everything about BlockFi. No, far more importantly and like many, I have simply lost faith in the SEC, their untransparent agenda, destructive stance on transformational technology instead of embracing it, and perhaps even, in their ability to follow reasonable procedures.

But, I digress. Bureaucratic regulatory and legal battles are currently being fought and will continue to be fought over the coming years and it's going to get nasty. Every narrative or legal avenue will be used to push towards Central Bank Digital Currencies, programmable money, negative interest rates and the ability to censor transactions on a scale never seen before, using the blockchain for bad, instead of for good. Ultimately, giving the issuer control over how the money is spent by the recipient. No king in history has ever had the power to control what people spend their money on or by when they must spend it. The Bank of England is (very actively) looking into it. I guess I missed the public debate about that. But hey, maybe it’s still to come!

The self-custody debate seems particularly topical and relevant in light of current events related to the Freedom Convoy of truckers in Canada, who had their funds frozen and seized. But even after that happened, their supporters could still send them bitcoin, because it is a permission-less and anti-fragile settlement layer.

That there was no evidence needed of suspicious transactions occurring related to this protest before seizing their assets is already unacceptable. Labelling this an emergency of such major proportions that it warrants lifting civil liberties is very dubious to say the least, as well. To me, it looks like these asset freezes don’t serve to end an emergency but to incapacitate and intimidate protesters after the fact.

And, in my view, as if it wasn’t bad enough, the absolute killer precedent being set here, was to define crime retroactively. A legal protest financed through legal means being criminalized after the fact, being labelled terrorist and punishable without trial. This means that if you had sent money to GoFundMe in good faith and without intent of breaking the law, you could still be charged with criminal charges or get financial sanctions.

Oh, most donors will be fine. And it was for an ‘emergency’, and it was temporary, so it’s OK, right?

It is never the right moment to stand up to incremental tyranny. By design.

This was done by the liberal Prime Minister of a G-7 country known for its extreme good nature and for generally being very easy going. And it wasn’t immediately condemned by other Western leaders. Today, maybe you are on Trudeau's side and dislike the truckers. Or you don’t have a strong opinion. But it is not always this way. What if Trump had done this to Black Lives Matters? In politics, it is usually wise to invert. The way to judge an idea is not if your team in power should do it. The way to judge the idea is if you think your worst political enemy should have this power and if you feel comfortable that the team you don’t like won't, ever, abuse it.

Holding your own money is not a crime. We can't meet in the middle on that one.

As I stand on the shoulders of giants, I’d like to quote the one and only Punk6529: ‘Don’t let the institutions steal your JPEGs.’

Financial systems underpin everything, including our constitutional rights.

There are no other constitutional rights in substance without freedom to transact.

Weaponizing the financial system to resolve domestic dissent or even criminal justice issues is a terrible precedent to set.

We must preserve self-custodial wallets at all costs.

Thanks for reading. If you liked this content, may I ask you to share it with just one person who you think might enjoy it as well? According to my calculations, if all of you share it with 1 person per post, I will have trillions of subscribers in about a year;)