Hunger Games

Well hello there, dear Reader. I have returned to Brussels after spending a little over a month in Dubai and Naïrobi. Coincidentally, it’s been exactly 3 years since my last day as an employee. Meanwhile, these are such unfortunate and turbulent times we find ourselves in. That calls for a blog.

Allow me to begin with the disclaimer that nothing in this blog constitutes of financial advice. I am not a financial professional and everything written here is for entertainment purposes only.

If only these folks would have given you the same disclaimer in September, right?

Oh, how wrong they were..

‘But the inflation is because of the Russian invasion of Ukraine’, some people have tried to tell me. Absolutely not. This is the line chart of Year-over-Year inflation:

Straight line up since the monetary stimulus following the beginning of the pandemic. Price charts never lie. Sure, the invasion of Ukraine will unfortunately have a devastating impact on certain aspects of the economy, but inflation has been running rife well before the war started. That is literally not debatable. So what does this mean? That I think Economics shouldn’t be labelled a science? Indeed I don’t. Or that I don’t think the monetary policy response to the pandemic was adequate? Not necessarily, I don’t know if other choices would have been better. But check this out:

Inflation data gets published once a month when the Consumer Price Index data comes out, so this was some downright cold misinformation in my opinion. Even if it was true, it couldn’t have been known. This was the day after the invasion.

Mainstream coverage pivoted from ‘There won’t be inflation’ to ‘There is no inflation’ to ‘Inflation is transitory’ to ‘Inflation was caused by X’. X ranging from the pandemic, to corporate greed, to the situation in Ukraine. But how much weight can really be given to the (vast majority of) hindsight analysis determining cause and effect? I find this truly fascinating. Was it incompetence, was it malice? I don’t seek to be conspiratorial, but being too complacent is just as much of a threat, in my opinion. It’s interesting to debate, important to define, but let’s just say that I think that the combination of ‘academic economical consensus’ and news headlines doesn’t help one make sound investment decisions.

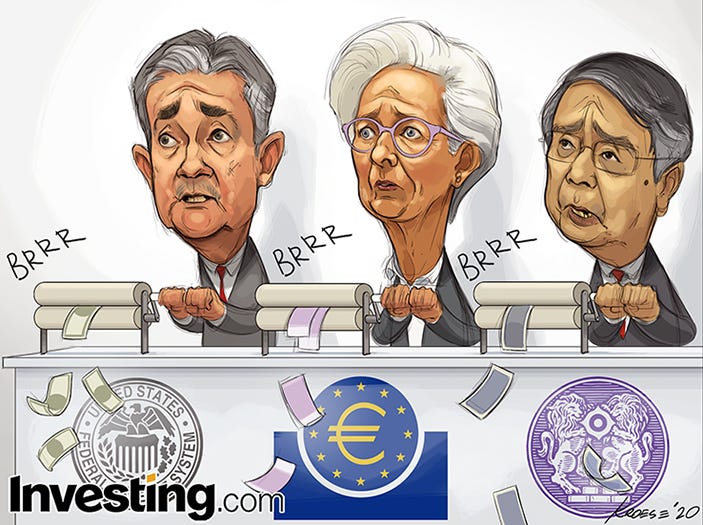

What makes the coverage about inflation even more peculiar to me is that, for the vast majority of my network, it was a basic and trivial observation that post-Covid monetary policy (colloquially known as ‘Money printer go Brrr’) caused inflation and rising asset prices. There was no need to have a fancy degree in Economics. For better or worse, the money supply has been greatly inflated, whereas the demand for the dollar is declining, arguably the real issue here, given the fact that the hegemony of the petrodollar as the world reserve currency has slowly been chopped away at for the last handful of years.

See for example the energy markets and the Chinese, Indians, Saudi-Arabians, Russians slowly but surely transacting in their own or more ‘neutral’ currencies from their point-of-view, reducing use of the dollar on the main stage. It is absolutely not my intention to make a political statement, nor to claim that I would have handled it differently, but it should be noted that one of the potential side-effects of sanctioning Russia’s US Dollar reserves is that other Nation States may very well start transacting, demanding payment and/or storing more of their wealth in (a basket of) other currencies, Gold, or even Bitcoin, to make themselves less ‘sanctionable’, thereby fundamentally reducing the demand for US dollars. World reserve currency status and paradigm shifts throughout its history is something I follow very closely as I have found it a very interesting topic for as long as I can remember. But this merits its own blog. (And in the meantime, if you would like to read about it, none other than Arthur Hayes himself wrote that the 26th of February 2022 could very well be viewed as the end of the financial system as we once knew it, in one of his signature thought provoking blog posts.)

Markets & Prices

Indeed, debating is always fun, but now that it has become more expensive to fill up one’s gas tank or to buy groceries, maybe it’s time to let go of certain contemporary beliefs and prepare for what’s, maybe and hopefully not, to come.

Next posts will be about how I attempt to navigate the markets during this turmoil. I have never felt more convinced of the fact that if one doesn’t at least learn the basics of trading, they -unfortunately- won’t truly be in control of their own standard of living anymore for the decades to come.

But these are treacherous waters out there. ‘No position’ means being in some kind of fiat currency, be it USD, EURO, or other, essentially being fully exposed to the risks of inflation and the loss of purchasing power, but not to stock market risk (or reward). Taking any other position (currently) means having to steer through seemingly hazardous and unsafe financial conditions as there seems to be an absence of a ‘comfy’, steadily trending, sort of ‘default’ position. Savings account gets you rekt, every other position, from Tech to Energy to Agriculture to Crypto, is acting volatile and is riddled with additional headline-risk for the over-leveraged.

Yes, markets have been tricky to trade since the correction that started in December. Big moves in both directions within a variety of asset classes, ample opportunity for all, but in a very volatile environment with plenty of additional event-based risk, where many assets have counter-intuitively known quite a big move upward since the Russian invasion of Ukraine. And since mid-March, the move up in a large part of all risk-on assets has fiercely accelerated, almost becoming a so-called ‘melt-up’.

It feels like we have arrived at an important juncture for the market, where many questions coincide.

Will a peace treaty be signed? Will inflation subside? Will central banks hike rates faster or slower? Aside from yes/no, how will markets even react to it and price it in? Is it a good time to invest in promising technologies with a longer time horizon, or is it best to wait for lower? What if the bottom is in? What if it’s not? How will we know?

Narratives and correlations are more complex at the moment than they were before. When that happens, focusing only on price can provide a lot of clarity and answers to help focus on a trader’s main task, which is not to predict what’s going to happen, but to align with the trend - or wait for one to develop. Some things I’ll be watching:

Let’s say you did in fact manage to ‘buy the fear’ of the stock market crash. Do you let your trade ride hoping for new highs, or do you take profit here after a bounce of a pretty historic magnitude?

If the Index pulls back, do you try to buy the dip or actually wait for new lows?

Is the bottom in for the Tech sector (Apple, Microsoft, Nvidia, et al), or is this just a bounce in a down-trending or sideways market?

What about the divergence between US/European/Emerging markets?

Is the energy sector just getting going, or is the move almost over?

Is investing in nuclear power a good idea now that public sentiment, policy and demand all seem to be shifting?

Will inflation get even worse, or is it close to normalizing now that it’s all over the news and very much on the minds of every politician and central banker out there?

And would good news really be good news for the markets, or does good news from Ukraine mean more room for fiscal tightening, and therefor becomes bad news for stocks even though great for the world?

What about the agriculture and fertilizer sector? They look like some very strong stocks, but is it a clear, tradeable trend or also a minefield for headline-driven moves?

Will cryptocurrency’s strength continue or are there signs of froth in the air and is it ready to take a breather? Are the recent cryptolaws passed in the EU good or bad? Does the market care?

What to do if you have no exposure or simply not enough? Which sectors do you choose? Good, solid, technology companies, or do you start trading wheat, oil&gas, uranium et al?

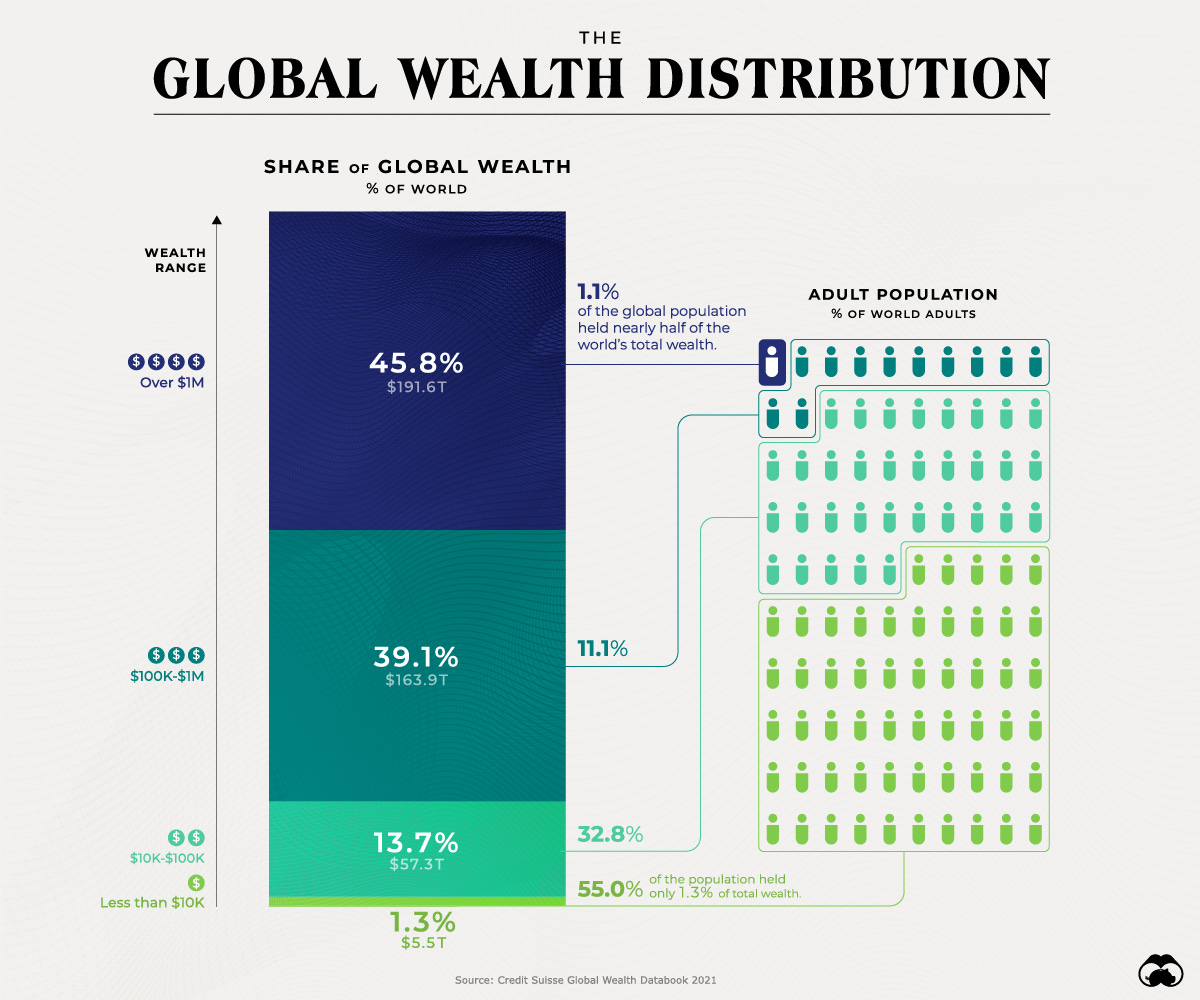

We’re about to find out as we go along. Pandemic, turmoil, war, famine, inflation, growing inequality, potentially increased social unrest. If it doesn’t end soon, a lot of people -that still have the privilege of having dispensable income- are going to be forced to make trades, and I hope to navigate it as well as I can and hopefully to be of help to some.

Stay safe out there and in control of your own fate if you can. I believe that means trust the price trends and volume, and alas, not much else. The age-old adage is not called ‘Sell the news’ for nothing. Or in other words, don’t always buy it.

Fun to read, honest and direct. Keep up the awesome work Nils.

It has to be said that we are manipulated all the time..