The differences between the game of trading and the game of poker is a topic that often crosses my mind. I could, and perhaps one day will, dedicate a longer post (or book?) to the vast nuances within this niche subject matter, but for all intended purposes, in this post I'll restrict myself to highlighting a few of them, which largely overlap.

Table selection

In poker, if one is adept at strategic analysis, mental calculation of probabilities, psychology and statistics, they'd be a good, possibly great, player. But if they would always play against the world's best players and never sit down against weaker opponents, they'd highly likely still lose all of their money in the long run. It is one of the skills that often flies under the radar when the broader public thinks about what is required to be a profitable poker player: table selection. Without it, most of the talent and skill someone has crafted over the years becomes nearly worthless. One must be wise in selecting their opponents, which is a skill in and of itself, that relates to various other areas in life.

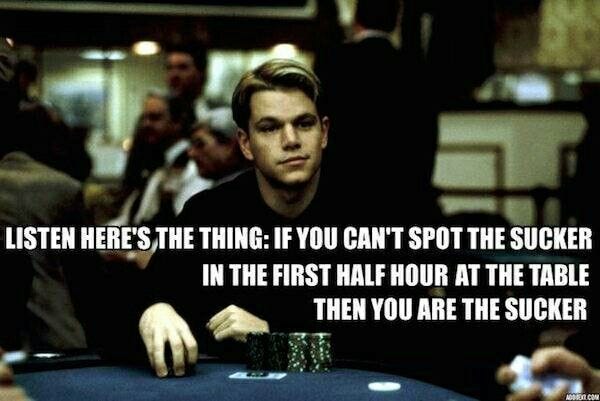

That concept doesn't translate easily to trading, because the market is the sum of all of its participants. Hedge funds, nation states, pension funds, skilled and cunning traders, ‘retail’ gamblers, your neighbor..in a sense they're all sitting at the same table. You can probably guess which group will end up being the sucker, but you can’t isolate them to make them your opponent. On top of that, markets trend. Can everybody win together? In trading and investing, sometimes (and more importantly, depending on the timeframe), yes, that’s certainly possible. In poker? Never.

One could argue, with some success, that in my comparison, 'the table' should thus be replaced by 'asset', because the asset one trades could be easier or more difficult than the other. The market for Tesla stock won't be comprised exactly of the same people as the ones trading the GBPEUR forex pair, which is probably only done consistently by professionals. So this would be a correct nuance, when it comes to the 'edge' or expected profitability one can have by making a certain bet. It’s a nuance that has merit, but is also incomplete, for it doesn't quite explain who you're playing against in the same clear-cut way as looking your opponents (or their avatars) in the eyes at a poker table would. Tesla vs. GBPEUR is mostly describing what you’re wagering on. If you lose money in your Tesla trade, who did you lose it to exactly? The line becomes vaguer, doesn’t it? Who made you lose it? Your 'opponent', or you? Your counterparty in the trade? Who made you do what you did? Did anyone force your decision? So, who is your opponent? Is it the market? Or is it you? Given the fact that a trader's main task is to be aligned with the market, surfing the wave of the trend, rather than to fight it, my opinion about this is that in trading, we are mostly battling ourselves.

Table Image

In poker, even with the most risk-averse strategy, you have to play a hand at least now and then, because 1) you will pay blinds and antes and 2) your opponents can see how you play and adjust their strategy. In trading, you can keep waiting and waiting for the conditions you desire and consider perfect. The waiting is mostly a skill. You don’t have to do anything, so why not wait for the ‘perfect hand’. In trading you can, in poker, you can’t. This implies that in poker you can both ‘be destroyed’ and self-destruct, but in trading you can only self-destruct. There is no social pressure or consequence to the actions you take because you don’t have a direct opponent. Nobody can see what you’re doing. You have no table image. And, borrowing a term from chess, this is the only thing that one needs to avoid:

Or at the very least, that’s how the market occasionally makes you feel:)

This concept is compounded by another big difference, namely that in poker, you can actually leave the table and stop the game, which won’t resume until whenever you decide to play again. In trading, can you? Sure, you could close your trades, but as posited in my last blog post, you'd still be in a position, most likely fiat money.

As I've learned from one of my mentors, all of this is what makes being 'comfortable with being uncomfortable' an essential survival skill for an aspiring trader.

Taming the self

Let's say you're in a trade and there isn't one clear-cut option for what to do next, IF there is even a need for you to do something to begin with. You don't know what to do with any reasonable degree of certainty. This situation occurs frequently because trading is miles apart from an exact science, let alone being a solved game.

You decide to take action and do something. Are you being resolute, or impulsive? Are you fearless and confident or are you being reckless? Let's say you don't take action. Are you being careful, or just too hesitant? Were you determined, or just stubborn? Are you riding the trend or are you being complacent? Zealous or overeager? Who is the judge? Once one becomes aware of the need to monitor the spectrum of any overly skewed sentiment, any equilibrium that is achieved is by definition strictly temporary.

Some of this implicit uncertainty can naturally be solved by 'planning the trade and trading the plan', largely taking the emotions out of the equation: 'Above price X, I buy more. Below price X, I cut my losses'. And the game goes on, because, if you always stick to the plan, are you being too rigid? If you change the plan, are you being flexible? Or do you just lack conviction? And what is the plan even based on?

It would be fun they said…

Even if one makes a basic plan that comes down to simple numbers/binary events and actions to help execute their trades, make no mistake about it, beneath the surface lurks an explosive cocktail of a wide range of emotions, needing to be either acknowledged, suppressed or embraced as soon as volatility rears its head. Hope, belief, despair, thrill, euphoria, denial, panic, fear, anger, disappointment; myriad triggers in an all-you-can eat buffet that never ends, serving up near endless potential, but where one either drowns themselves in trading sins like greed, envy, pride and gluttony, or simply rides the profitable waves in a composed, timely and balanced manner, never overindulging due to the continuous temptation. The differences can be small on the surface, but exponentially huge in terms of success or well-being.

In any event, even though not 110% confirmed, it is imperative to at least be willing to entertain the thought that we are often our own opponents, and that knowledge of the habits, strengths and weaknesses of opponents, in this case the self, can be key.

Oh, for the avoidance of doubt, borrowing from the one and only Cobie on Substack and Twitter: None of this financial advice. I’m not a professional and mostly am stumbling my way through the world the same way I was at age 13. I, like everyone else, am simply an aged baby walking blindfolded into a forest, startled by my own humanity. :)

PS: I’ve never really written a blog. As a beginner, I’d be very grateful for two things: feedback (on length, frequency, readability, etcetera) on posts from a reader’s POV, as well as an audience that grows over time. So please don’t hesitate to share this young creation:) Next posts step away from trading & poker.

Your dialogue reads very natural and in character-your own experience- which I find inspiring despite my lack of understanding in stocks and now, poker.

As a blogger, you’re on the right path. Your intent to drift away from the aforementioned on your future articles is an added advantage-I speak for myself :) I’m a huge fan already.

I also believe the world is slowing shifting focus to capital markets and global security exchange, therefore we can’t get enough of your own experience which poses as a learning curve.

I am excited for your next encounter.

You've got that little something that makes even the most incomprehensible text (for someone neither into poker nor trading) somehow enjoyable and really quite interesting. Despite not having googled what GBPEUR is, I enjoyed reading you. It was both fun and inspiring. :-)

This particulate post was maybe a tad long for me, but then again, I suppose your standard reader knows what GBPEUR is.

PS: I suspect a typo in the paragraph following Zugswang: but as posited in my last blog post?

Also, you asked fot it... :-) Great frequency, keep it up.