Right-click save

To pick up where we left off, what the technology behind NFTs leads to is the ability to own and exchange digital goods in a way that wasn’t possible before. The only thing one could really own on the internet used to be a domain name. Now, you can own and keep Bitcoin, Ethereum, other currencies or tokens, as well as NFTs to record digital and provable ownership, made possible by blockchains, namely ‘a group of otherwise independent actors, each acting out of pure self-interest, coming together to produce something for the good of all, an immutable record that everyone can trust and that's not managed by a single, centralized intermediary.’ (The Truth Machine, 2018)

This could mean various forms of data, any form of a binding contract, a ticket to a concert, an item from a videogame, marriage and birth records, proof of ownership of a house in the real world provable by a unique NFT, and the list goes on.

Digital scarcity and property, in the same way that there is physical scarcity and property. In a world where the internet as we know it is still only a few decades old and increasingly more time in our lives is spent online (and with every large tech company making a play at the Metaverse narrative to boot), in retrospect, it was always just going to be a matter of time before we could have digital property and 'keep our stuff’.

The cross-over between digital and physical world has also seen a notable uptick:

Already from 2017 onward, the United Nation’s World Food Programme started piloting blockchains to facilitate community governance and management of resources in Syrian refugee camps, as a reliable and immediate way to trace transactions. In often desolate places where theft is rampant and few people carry ID, this helps to better coordinate food distribution, aided by decentralized double bookkeeping. And on a different end of the spectrum, the deed of a house was sold as an NFT last week in Tampa Bay, as one of the first experiments of its sort.

If you're a notary, an accountant or even an insurance broker and you think your work won't be replaced by NFTs or a blockchain in the next ten years (at most), where is your stop-loss on that stance and how do you plan to innovate? The clock is ticking.

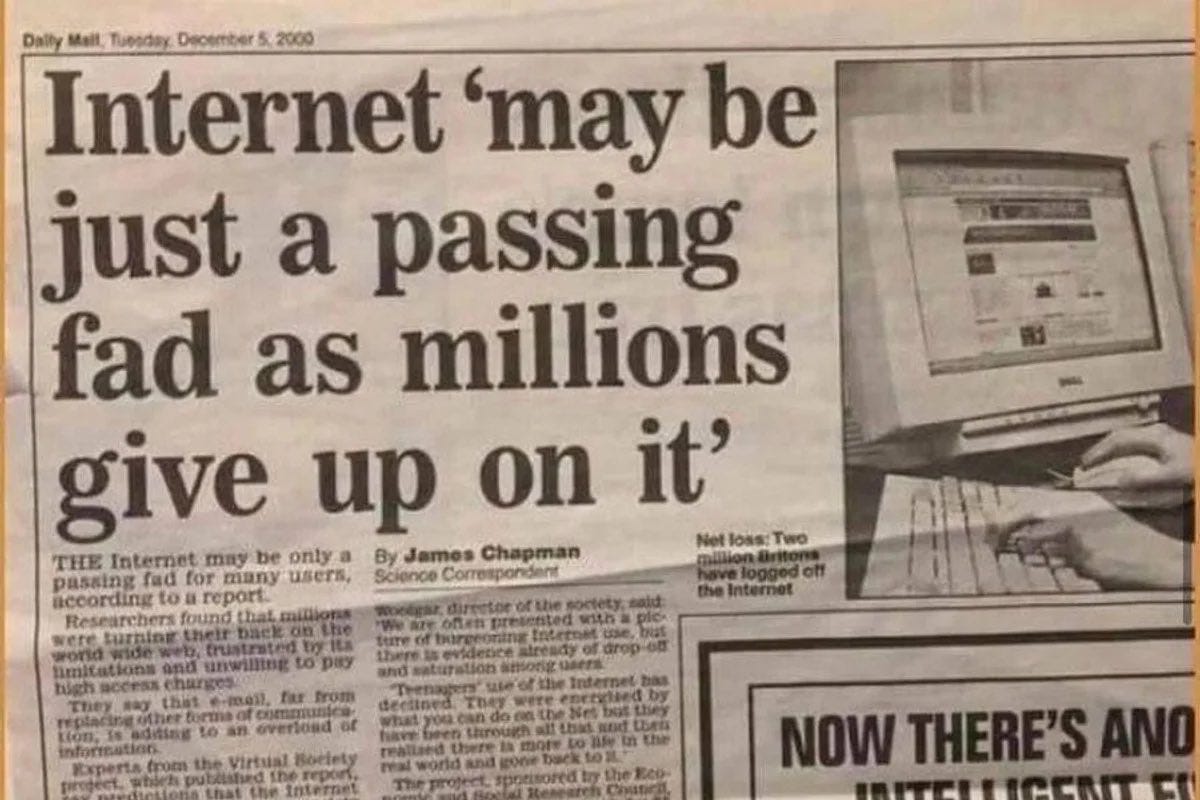

‘Science correspondent’ and ‘according to a report’. Well, that’s nice and very reassuring. Feels like the more things change, the more they stay the same.

Skepticism

All nascent technologies are first met with extreme skepticism, regardless of how obvious their revolutionary attributes seem to us in retrospect. Cars, airplanes, calculators, computers, cryptocurrency and pretty much everything else that’s ever been invented.

I often hear people tell themselves some version of 'If I would have been able to buy X in year Y, I would have [this much lots of money] now.' And to that I say: no, you probably wouldn't have, and neither would I. We would have sold for a small gain or gotten out in the face of adversity. A small loss or a small win. That is unfortunately far more likely than holding a young and volatile asset for multiple years, utterly unfazed, and without a care in the world.

The only thing I want to underline with this statement is that the thought needs to be entertained that NFTs are our next opportunity in that list and plenty of people are again saying it's just a fad, despite budding adoption and the strong fundamental backdrop for this asset class to potentially thrive. Wouldn't staying heavily opposed to NFTs be very similar to not paying attention in the dotcom bubble or the crypto bubble, or any other period of froth in a certain asset class? I wish I had learnt this earlier in life, but it seems that a little curiosity, pushing oneself to get some skin in the game, often pays off asymmetrically. On average much more so than, say, sticking with the default skeptical stance that we are spoon-fed by the habitually dubiously biased and framing legacy media, where journalists keep their jobs, regardless of whether they ever turn out to be correct or not. If your risk is managed, what could go wrong? Besides:

Yes I know, crazy statistic, I didn’t know that either.

And lastly, in the vast majority of cases, when a bubble ‘bubbles’ for the second time, it is no longer a bubble but has simply matured to an asset class. I believe the conventional investing wisdom phrasing is ‘never fade the second coming'. So let's zoom in on the breeding ground for a lot of the, in my opinion borderline off-topic, yet persistent, skepticism.

'Art' and status.

What, don't you find these rare, or should I say, provably unique, profile pictures to be of exquisitely refined taste? The list of celebrities owning a Bored Ape disagrees. From Jay-Z to Justin Bieber, Jimmy Fallon, The Chainsmokers, Paris Hilton, Neymar, Steph Curry, Shaquille O'Neal, Serena Williams and Eminem all the way to Snoop Dogg (unironically an NFT OG and great follow).

They will gladly show the world that they are part of the exclusive BAYC (and interestingly, if they ever sell, it will be traceable), sending out social signals by flexing their respective avatars to their enormous followings. Instead of having an expensive painting in their homes that hardly anybody can see, they can exhibit their NFT to the whole world in the digital realm! Flaunting their digital swagger on the world’s biggest stage, perhaps even creating new viral brands in the process. Is that a feature or a bug, in a world where status and fame often end up defining taste? In my opinion, it just is.

The numbers are head-turning: NFT sales volume totaled $25 billion in 2021, compared to just $95 million in 2020. Already in 2022, daily sales on Opensea, the popular peer-to-peer marketplace for NFT, have reached all-time highs.

It’s not so much that I think art is the ‘killer app’ for NFTs, than that it could be the Trojan horse that opens the door for all other use-cases. So I’ll gladly touch on the subject of art and taste a bit more, even though I know nothing about art. I believe I can convincingly defend it as a use-case that will stick around, and I certainly wouldn’t bet against NFTs devouring the art world in the next ten years.

First of all, artists are heavily incentivized to jump on the NFT train. Because they can make and sell their digital private artwork / property, there is no need (unless they want it) for agents, brokers, curators or intermediaries for payments. Based on that alone, would you bet that the % of NFTs in the art world will become smaller or greater than it is right now, today?

‘The art that becomes fine art in today’s world and fetches mind boggling prices often passes through the hands of just a few choice kingmakers clustered in the Western world. This makes it almost impossible for the vast majority of global artists from all around the world to ever have a real shot at breaking into the high end contemporary art market.

Conversely, with even the most rudimentary NFT platforms burgeoning today, access has become infinitely more accessible to everyone, allowing all talent from anywhere to have a fair shot at hitting the cultural zeitgeist on its head and making it big.’ (Ben Yu, 2021)

Oh, and lest I forget, they can keep a piece of the pie of their secondary sales by easy to implement smart contracts.

If you add to the equation that Sotheby’s, Christies et al have already jumped on board as well, it becomes easier to imagine a future in which NFTs are the leading medium for visual art.

On the topic of ‘taste’, it should be noted that many artists were only appreciated long after their death (let’s say Van Gogh), or that one of their pieces is valued at many multiples of another piece (a painting that is 50x as expensive as another painting isn’t by definition 50x as ‘nice’). This makes it difficult to speak of a consensus about the inherent ‘value’ of traditional paintings so clear (let alone the subjective valuations of abstract/modern art) that it could ever be the crux of a strong argument against the rise of digital art, at this point. You can’t put the toothpaste back in the tube. I’m not arguing that artistic NFTs are valuable, I’m arguing that either nothing is valuable or everything can be valuable.

What is the idea of taste truly underpinned by, if not for the artists, the auction houses, the gallerists, the rich collector clientele, artworks not changing hands too quickly and ultimately ‘the hope that the new wealthy will pump the art bags of the old wealthy, such that valuations keep rising’? (Arthur Hayes, legend, I salute you.)

A ‘Fidenza’ (‘Generative Art’), going for 3.35 million United States Dollars.

Artistic Innovations

Somewhere in Italy, circa 1364

Traditional art has existed for thousands of years. Regardless of how the Metaverse develops, there will always be an appreciation for certain works of physical art.

That said, aside from enabling more artistic growth and creativity thanks to the possible removal and reduction of middle-men, let’s have a rapid fire list of some more potential innovations:

NFTs have more permanence and value retention than physical objects. No degradation.

Liquidity to get in and out of art trades/investments is much greater than in physical world.

Easy borrowing against your NFT assets as collateral.

Trivial fractionalized ownership of NFT assets.

And my personal favorites:

Traceability of ownership. Imagine being able to know exactly who the Mona Lisa belonged to, when exactly it was traded, between who and for how much money.

Simply unforgeable due to the cryptographic nature. There can only be one.

But what about Right Click Save?

A common misconception is that NFTs have no value because ‘they can just be right click saved’. I would take the opposite side of that bet, any day. The more copies, the more valuable. Infinite replication for free is a tremendous feature, not a bug. You can provable own the original, beyond any cryptographic doubt. Museums and collectors all around the globe have gone through great lengths to own the original rather than a replica (and to prove it), for centuries. Why would this end now? That’s like betting against human nature.

What is the security guard protecting, when the private keys are stored elsewhere? The Ipads? Not the NFT, I’ll tell you that much.

Zero

Plenty of NFTs will end up being overhyped and go to zero. Likely the vast majority of them. And even though I don’t particularly like trading NFTs due to their ‘collectibles’ style of trading and appurtenant liquidity profiles, I would hope I don’t let that deter me from keeping my eye on the bigger picture when the initial storm passes, namely that NFTs are potentially a once-in-a-generation transformative technological innovation, capable of fundamentally changing every aspect of the digital economy in the future. Just a few decades ago, people weren’t even sold on the internet. I believe it is very reasonable to state that the long-term success of NFTs will not be defined by the cash-grabs reported by legacy media.

After this long interlude about art that I felt was needed to provide a somewhat comprehensive overview of the extensive topic that NFTs have become, in my mind I have finally paved the way to get to what I believe to be the fundamental essence of the NFT debate next. I will end the NFT blogging series on a high, namely by writing about what I’m most passionate about and where my heart truly lies. Identity and self-custody.